Why Do I Have Two W-2s From The Same Employer? - Intriguing Insights

Do you have two W-2s from the same employer? You're not alone. It's a common question with a few possible explanations.

One possibility is that you worked for the same employer in two different states. In this case, you will receive a W-2 from each state for the income you earned in that state. You will need to file a tax return in each state, and you may be subject to taxes in both states.

Another possibility is that you received a bonus or other supplemental income from your employer. This income may be reported on a separate W-2, even if you received it from the same employer as your regular wages.

- Unmasking The Excitement Sophie Rains Spiderman Video On Youtube Takes The World By Storm

- Filmyfly Dilwale The Ultimate Guide To Your Favorite Movie Streaming Destination

Finally, it is also possible that you received a corrected W-2 from your employer. This could happen if there was an error on your original W-2. If you receive a corrected W-2, you should use it to file your taxes.

No matter why you received two W-2s from the same employer, it is important to make sure that you report all of your income on your tax return. If you are not sure how to do this, you can consult with a tax professional.

Why Do I Have Two W-2s From the Same Employer?

Receiving two W-2s from the same employer can be confusing, but it's usually due to one of the following reasons:

- Discover Latest Bollywood Hollywood Movies Top Choices For Every Movie Buff

- Exploring The Fascinating Life Of Camilla Araujo Of Naked

- Multiple States: If you worked in multiple states, you'll receive a W-2 from each state for the income you earned there.

- Supplemental Income: Bonuses, commissions, or other supplemental income may be reported on a separate W-2.

- Corrected W-2: If there was an error on your original W-2, you may receive a corrected one.

- Employer Error: Sometimes, employers make mistakes and issue duplicate W-2s.

- Name Change: If you changed your name during the year, you may receive two W-2s with different names.

- SSN/EIN Error: If there was an error in your Social Security number or employer identification number, you may receive multiple W-2s.

- Multiple Jobs: If you worked multiple jobs for the same employer, you may receive a separate W-2 for each job.

- Terminated and Rehired: If you were terminated and then rehired by the same employer, you may receive two W-2s.

No matter the reason, it's important to report all of your income on your tax return. If you're not sure how to handle two W-2s from the same employer, consult a tax professional for guidance.

1. Multiple States

If you work in multiple states, you will receive a W-2 from each state for the income you earned in that state. This is because each state has its own tax laws and regulations, and you are required to file a tax return in each state where you earned income.

For example, if you live in California but work in both California and Nevada, you will receive two W-2s: one from California for the income you earned in California, and one from Nevada for the income you earned in Nevada. You will need to file a tax return in both California and Nevada, and you may be subject to taxes in both states.

It is important to report all of your income on your tax return, even if you received multiple W-2s from the same employer. If you are not sure how to handle two W-2s from the same employer, you can consult with a tax professional.

Understanding the connection between working in multiple states and receiving multiple W-2s is important for ensuring that you are filing your taxes correctly and paying the correct amount of taxes.

2. Supplemental Income

Supplemental income is any income that you receive outside of your regular wages. This can include bonuses, commissions, prizes, and awards. Supplemental income is often reported on a separate W-2 from your regular wages. This is because supplemental income is taxed differently than regular wages.

Supplemental income can also lead to multiple W-2s from the same employer. This can occur if your supplemental income is from a different source than your wages. As an example, if you receive a bonus from your employer, this bonus may be reported on a separate W-2. This is because the bonus is not considered part of your regular wages.3. Corrected W-2

Receiving a corrected W-2 is a common occurrence, and it can happen for a variety of reasons. One reason is that the employer made a mistake on the original W-2. This could be a simple error, such as a typographical error, or it could be a more complex error, such as an error in calculating the employee's income or withholdings. Another reason for receiving a corrected W-2 is that the employee's circumstances changed after the original W-2 was issued. For example, the employee may have changed their name or address, or they may have received additional income or deductions that were not included on the original W-2.

When an employer issues a corrected W-2, they are required to send the employee a copy of the corrected W-2. The employee should then use the corrected W-2 to file their tax return. If an employee receives a corrected W-2, it is important to make sure that they report the corrected information on their tax return. Failure to do so could result in the employee paying too much or too little in taxes.

Understanding the connection between receiving a corrected W-2 and having two W-2s from the same employer is important because it can help employees to avoid making mistakes on their tax returns. If an employee receives two W-2s from the same employer, they should compare the two W-2s to see if there are any differences. If there are any differences, the employee should contact their employer to determine which W-2 is correct. The employee should then use the correct W-2 to file their tax return.

4. Employer Error

An employer error can occur in many different ways: a data entry error, a miscalculation, or simply an oversight. One example of an employer error is when an employee receives two W-2s with the same information. This can be confusing for the employee, and it can lead to errors when filing their taxes. Furthermore, it can significantly impact tax calculations and deductions.

Understanding the connection between employer errors and receiving two W-2s from the same employer is important for several reasons. First, it helps employees understand why they may have received two W-2s. Second, knowing the most common reason for employer error can help taxpayers avoid potential tax issues. Finally, it helps employees to understand the importance of carefully reviewing all tax documents before filing their taxes.

To avoid any confusion or errors, employees should carefully review all tax documents. If an employee receives two W-2s with the same information, they should contact their employer to determine which W-2 is correct. The employee should then use the correct W-2 to file their tax return.

5. Name Change

When an individual changes their name during the tax year, it can result in receiving multiple W-2s with different names. This can occur due to various reasons, such as marriage, divorce, or legal name changes. Understanding the connection between a name change and receiving two W-2s is crucial to ensure accurate tax filing and avoid potential complications.

For instance, if an employee legally changes their name after starting a new job, they may receive two W-2s for the same tax year. The first W-2 will reflect their old name, while the second W-2 will reflect their new name. This can be confusing for the employee, as they may be unsure which W-2 to use when filing their taxes. As a result, it is important for employees to notify their employer promptly about any name changes to prevent duplicate W-2s.

It is essential to report all income earned under both names on the tax return to avoid discrepancies or errors. In such cases, it is advisable to attach a statement to the tax return explaining the name change and providing supporting documentation, such as a marriage certificate or court order, to substantiate the change. Proper handling of name changes on W-2s helps ensure accurate tax calculations, reduces the risk of tax-related issues, and streamlines the overall tax filing process.

6. SSN/EIN Error

An error in your Social Security number (SSN) or employer identification number (EIN) can lead to receiving multiple W-2s from the same employer. This typically occurs when the employer makes a mistake when reporting your SSN or EIN to the IRS. As a result, the IRS may create multiple records for the same individual or business, resulting in the issuance of duplicate W-2s.

Receiving multiple W-2s due to an SSN or EIN error can be confusing and poses challenges when filing taxes. It is important to rectify the error promptly to avoid potential tax-related issues and ensure accurate tax calculations.

To resolve the issue, you should contact your employer and inform them of the error. They will need to correct their records and re-submit the W-2 with the correct information to the IRS. Once the correction is processed, you will receive a corrected W-2. You should use the corrected W-2 when filing your taxes to ensure accurate reporting of your income and avoid any discrepancies.

7. Multiple Jobs

Receiving multiple W-2s from the same employer can stem from holding multiple jobs within the organization. When an individual is employed in different capacities or departments within the same company, they may receive a separate W-2 for each job, reflecting the earnings and withholdings associated with each role. Understanding this connection is vital for accurate tax reporting and claiming relevant deductions and credits.

For instance, an employee who works as both a software engineer and a part-time instructor for the same university may receive two W-2s. One W-2 will report the income and withholdings related to their software engineering role, while the other W-2 will reflect the earnings and withholdings from their part-time teaching position. This distinction ensures that the employee's income from each job is properly accounted for and taxed accordingly.

Recognizing this connection empowers individuals to avoid potential tax-related issues and ensures that their tax liability is calculated correctly. It also enables taxpayers to maximize their deductions and credits by accurately reporting all income earned from various jobs within the same organization.

8. Terminated and Rehired

Receiving multiple W-2s from the same employer can occur due to various reasons, one of which is termination and subsequent rehiring. Understanding this connection is crucial for accurate tax reporting and resolving any confusion surrounding the receipt of multiple W-2s.

When an employee is terminated and later rehired by the same employer, they may receive two W-2s for the same tax year. The first W-2 will reflect the income and withholdings up until the date of termination, while the second W-2 will report the income and withholdings from the date of rehiring onwards. This distinction ensures that the employee's income and tax liability are accurately accounted for during both periods of employment.

Recognizing this connection empowers individuals to avoid potential tax-related issues and ensures that their tax liability is calculated correctly. It also enables taxpayers to maximize their deductions and credits by accurately reporting all income earned during both periods of employment with the same employer. Properly handling multiple W-2s resulting from termination and rehiring is essential for accurate tax filing and ensuring compliance with tax regulations.

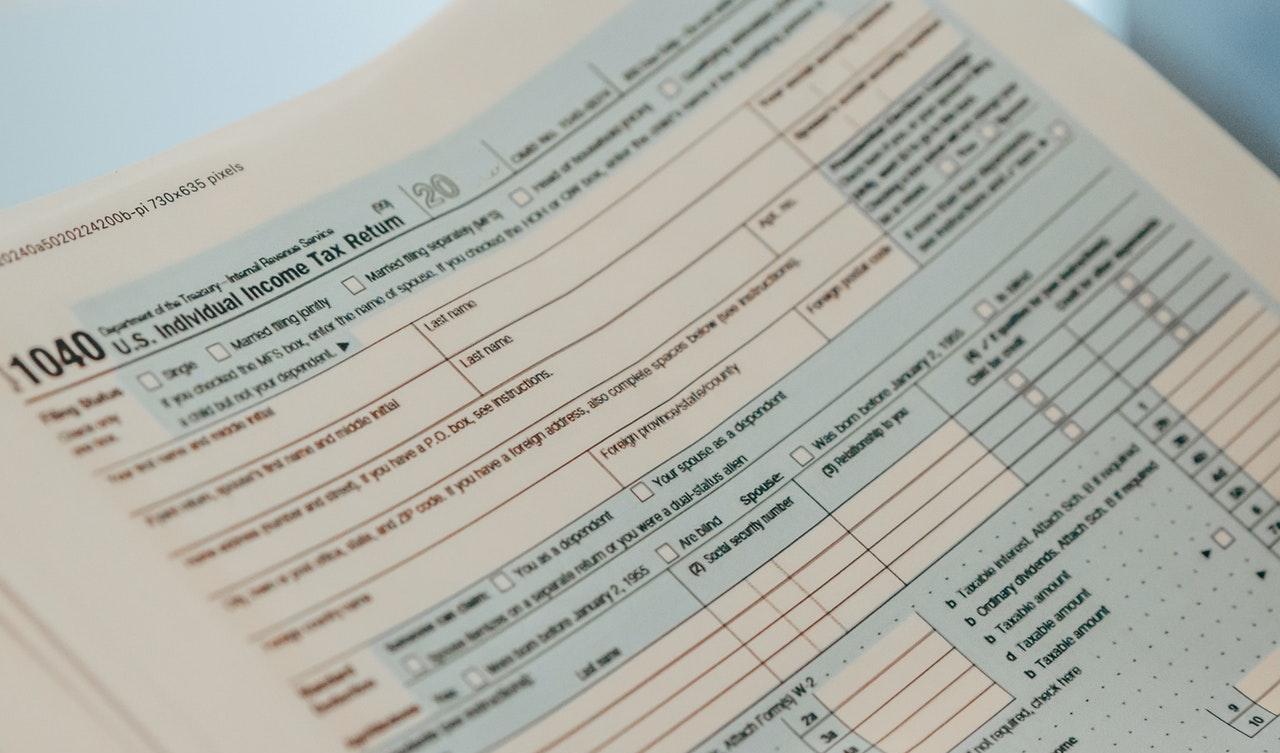

FAQs about "Why Do I Have Two W-2s from the Same Employer?"

Receiving multiple W-2s from the same employer can raise questions and confusion. Here are answers to some frequently asked questions to provide clarity and guidance:

Question 1: Why might I receive two W-2s from the same employer?

Answer: There are several reasons why you may receive two W-2s from the same employer, such as working in multiple states, receiving supplemental income, receiving a corrected W-2, or due to an employer error.

Question 2: What should I do if I receive two W-2s for the same year from the same employer?

Answer: If you receive two W-2s from the same employer for the same tax year, compare the information on both forms carefully. Use the W-2 that has the highest total income and withholdings to file your tax return.

Question 3: How do I handle taxes if I have two W-2s from the same employer?

Answer: When filing your tax return, combine the income and withholdings from both W-2s. Report the combined totals on your tax return to ensure accurate tax calculations.

Question 4: What if I have questions or need assistance with two W-2s from the same employer?

Answer: If you have questions or need assistance understanding your W-2s, you can contact the Internal Revenue Service (IRS) at 1-800-829-1040. You can also seek guidance from a tax professional for personalized advice.

Question 5: Is it common to receive two W-2s from the same employer?

Answer: While not as common, receiving two W-2s from the same employer is not uncommon. It can occur due to various reasons as mentioned earlier. It is important to understand the reasons and handle the situation appropriately to ensure accurate tax reporting.

Understanding the reasons for receiving multiple W-2s from the same employer and knowing how to handle them properly is essential for accurate tax filing and compliance with tax regulations.

Transition to the next article section: For further information on tax-related matters, please refer to the additional resources and expert insights provided in the following sections.

Conclusion

Receiving multiple W-2s from a single employer can be confusing, but it is important to understand the reasons behind this occurrence to ensure accurate tax reporting and compliance. This article has explored the various circumstances that can lead to receiving two W-2s from the same employer, ranging from working in multiple states to employer errors.

It is crucial to carefully examine the information on both W-2s, compare the income and withholding amounts, and use the form with the higher totals for tax filing. If you have any questions or require assistance, do not hesitate to contact the IRS or seek guidance from a tax professional. Understanding the reasons for receiving multiple W-2s and handling them appropriately is essential for fulfilling tax obligations accurately.

Detail Author:

- Name : Mr. Cordelia Hahn

- Username : winnifred50

- Email : mrodriguez@yahoo.com

- Birthdate : 1995-02-21

- Address : 1165 Boyer Center Apt. 566 Robertsmouth, WY 47675-4693

- Phone : 1-812-735-0051

- Company : Jast, Zulauf and Schmidt

- Job : Biochemist

- Bio : Et corrupti quibusdam eius et. Quam aut consequatur in natus delectus et. Impedit sit beatae ipsa voluptatibus aut est. Enim repellat id pariatur suscipit quidem nobis doloribus.

Socials

twitter:

- url : https://twitter.com/schulist1998

- username : schulist1998

- bio : Vel sequi consequuntur et tempore et quaerat qui id. Quo dignissimos dolor eum quos. Enim repudiandae nulla est. Dolorem ea veritatis magnam et.

- followers : 1405

- following : 1438

facebook:

- url : https://facebook.com/mossie.schulist

- username : mossie.schulist

- bio : Autem doloremque pariatur libero consequuntur optio.

- followers : 4098

- following : 198