Get Your Robinhood 1099 Date: Timing Your Taxes

What is a Robinhood 1099 date?

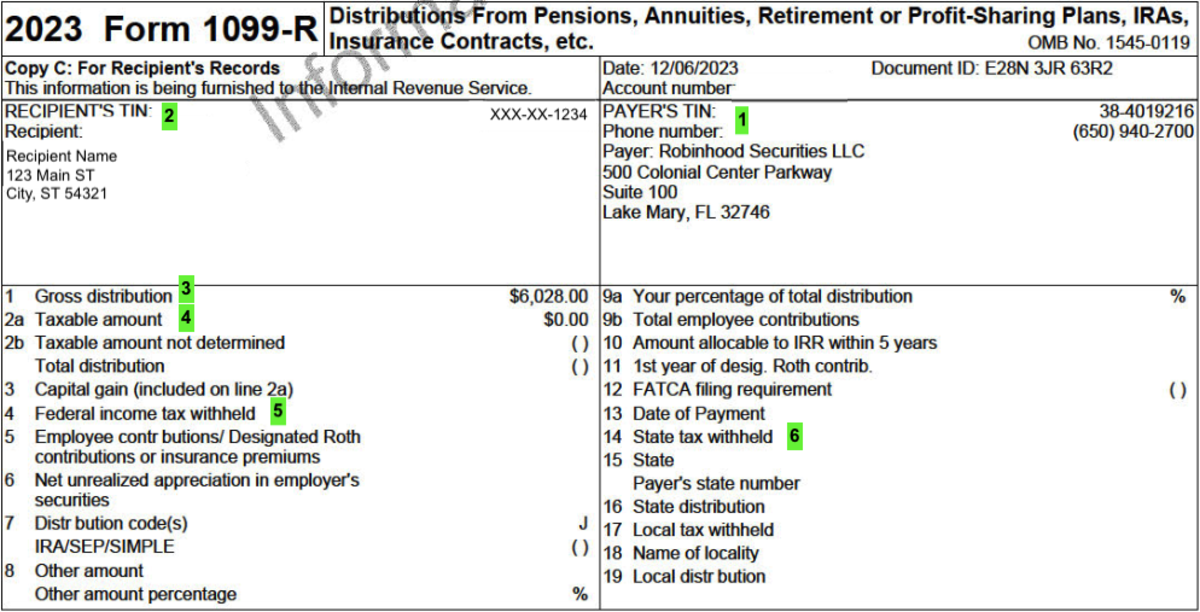

A Robinhood 1099 date is the date on which Robinhood, a popular online brokerage firm, issues Form 1099 to its users. Form 1099 is a tax document that reports income earned from various sources, including dividends, capital gains, and interest.

The Robinhood 1099 date is important because it helps users determine the tax liability associated with their Robinhood account activity. Users must report the income reported on their 1099 to the Internal Revenue Service (IRS) when filing their taxes.

- Bollyflix Ullu Web Series Download Filmyzilla Your Ultimate Guide To Entertainment

- Conan Obriens Kids Meet Neve Beckett What You Need To Know

Robinhood typically issues 1099 forms in late January or early February. Users can access their 1099 forms online through their Robinhood account.

Robinhood 1099 Date

The Robinhood 1099 date is an important piece of information for users of the Robinhood online brokerage platform. This date determines when users can expect to receive their Form 1099 from Robinhood, which reports income earned from various sources, including dividends, capital gains, and interest.

- Timing: Robinhood typically issues 1099 forms in late January or early February.

- Importance: The 1099 date is important because it helps users determine their tax liability associated with their Robinhood account activity.

- Access: Users can access their 1099 forms online through their Robinhood account.

- Accuracy: It is important to review the 1099 form carefully to ensure that all income is reported accurately.

- Filing: Users must report the income reported on their 1099 to the Internal Revenue Service (IRS) when filing their taxes.

- Consequences: Failing to report income from Robinhood can result in penalties and interest charges.

By understanding these key aspects of the Robinhood 1099 date, users can ensure that they are meeting their tax obligations and avoiding any potential penalties.

- Best Bollywood Movies And Tv Shows On Hdhub4u For Seamless Downloads

- Explore Bolly4u Your Ultimate Guide To Free Bollywood Movies And More

1. Timing

The timing of Robinhood's 1099 issuance is significant for several reasons. Firstly, it helps users plan for tax season. By knowing when to expect their 1099 forms, users can gather the necessary documentation and prepare their taxes accordingly. Secondly, the 1099 date serves as a reminder for users to review their Robinhood account activity and ensure that all income is accurately reported. This can help prevent errors or omissions that could lead to tax penalties.

For example, if a user expects to receive their 1099 form from Robinhood in late January, they can start gathering their other tax documents and researching any applicable deductions or credits. This proactive approach can help them file their taxes accurately and efficiently.

Overall, understanding the connection between "Timing: Robinhood typically issues 1099 forms in late January or early February." and "robinhood 1099 date" empowers users to be well-prepared for tax season and avoid potential tax-related issues.

2. Importance

The connection between the Robinhood 1099 date and its importance in determining tax liability is crucial for users of the platform. The 1099 date serves as a reference point for users to understand the timeline for receiving their tax documents and accurately reporting their income.

- Tax Obligations: The 1099 date helps users fulfill their tax obligations by providing them with the necessary information to report their Robinhood earnings to the Internal Revenue Service (IRS). This ensures that users are meeting their tax responsibilities and avoiding potential penalties.

- Income Tracking: The 1099 date allows users to track their income earned through Robinhood, including dividends, capital gains, and interest. This comprehensive view of their financial activity helps users make informed decisions about tax planning and investment strategies.

- Tax Liability Estimation: Based on the information provided in the 1099 form, users can estimate their potential tax liability associated with their Robinhood account activity. This estimation enables them to plan accordingly and make necessary adjustments to their financial strategies.

- Accuracy and Compliance: The 1099 date ensures that users have sufficient time to review their Robinhood account activity and verify the accuracy of the reported income. This promotes compliance with tax regulations and helps users avoid any discrepancies or errors.

Overall, the Robinhood 1099 date empowers users to be proactive in managing their tax liabilities and making informed financial decisions. By understanding the significance of the 1099 date, users can stay compliant with tax regulations and optimize their tax strategies.

3. Access

The connection between "Access: Users can access their 1099 forms online through their Robinhood account" and "robinhood 1099 date" lies in the convenience and efficiency it offers to Robinhood users in managing their tax-related documents.

The Robinhood 1099 date signifies the availability of 1099 forms to users, enabling them to access their tax information promptly. By providing online access to 1099 forms, Robinhood simplifies the process of retrieving and reviewing tax documents. This eliminates the need for users to wait for physical mail or contact customer support, saving them valuable time and effort.

Furthermore, online access to 1099 forms through Robinhood empowers users to securely store and manage their tax documents in one central location. This ease of access allows users to stay organized and have their tax information readily available for reference or sharing with tax professionals, ensuring a smoother and more efficient tax preparation process.

In conclusion, the connection between "Access: Users can access their 1099 forms online through their Robinhood account" and "robinhood 1099 date" underscores the commitment of Robinhood to provide a user-friendly and streamlined tax document retrieval system. By leveraging online access, Robinhood empowers its users to conveniently manage their tax-related information, ultimately contributing to a more organized and efficient tax preparation experience.

4. Accuracy

The connection between accuracy and the Robinhood 1099 date is crucial because it ensures that users can rely on the information provided in their 1099 forms to accurately report their income and tax liability. The Robinhood 1099 date serves as a reference point for users to receive their tax documents and verify the accuracy of the reported information.

By carefully reviewing their 1099 forms, users can identify any discrepancies or errors in the reported income, such as missing or incorrect dividend payments, capital gains, or interest earned. This review process is essential for ensuring compliance with tax regulations and avoiding potential penalties or interest charges. Furthermore, accurate reporting of income helps users optimize their tax strategies and make informed financial decisions.

For example, if a user receives their Robinhood 1099 form in late January and discovers an error in the reported dividend income, they can promptly contact Robinhood's customer support team to rectify the issue before filing their taxes. This proactive approach ensures that the user's tax return is accurate and complete, reducing the risk of errors or delays in processing.

In conclusion, the connection between "Accuracy: It is important to review the 1099 form carefully to ensure that all income is reported accurately" and "robinhood 1099 date" underscores the importance of accuracy in tax reporting. By understanding this connection, users can take proactive steps to review their 1099 forms, identify any errors, and ensure the accuracy of their tax filings.

5. Filing

The connection between "Filing: Users must report the income reported on their 1099 to the Internal Revenue Service (IRS) when filing their taxes" and "robinhood 1099 date" lies in the crucial role of the 1099 date in ensuring timely and accurate tax reporting.

- Tax Obligations: The Robinhood 1099 date helps users fulfill their tax obligations by providing the necessary information to report their Robinhood earnings to the IRS. This ensures that users are meeting their tax responsibilities and avoiding potential penalties.

- Accuracy and Compliance: The Robinhood 1099 date provides users with ample time to review their Robinhood account activity and verify the accuracy of the reported income. This promotes compliance with tax regulations and helps users avoid discrepancies or errors that could lead to issues with the IRS.

- Timely Filing: Knowing the Robinhood 1099 date allows users to plan ahead and ensures that they have sufficient time to gather the necessary tax documents and file their taxes accurately and on time. This helps avoid delays or penalties associated with late filing.

- Audit Preparedness: By carefully reviewing their 1099 forms and accurately reporting their income, users can increase their preparedness in the event of an IRS audit. Having accurate documentation reduces the risk of errors or discrepancies that could lead to additional scrutiny or tax assessments.

In summary, the connection between "Filing: Users must report the income reported on their 1099 to the Internal Revenue Service (IRS) when filing their taxes" and "robinhood 1099 date" emphasizes the importance of accurate and timely tax reporting. The 1099 date serves as a reference point for users to receive their tax documents, review their income, and ensure compliance with tax regulations, minimizing the risk of penalties or issues with the IRS.

6. Consequences

The connection between "Consequences: Failing to report income from Robinhood can result in penalties and interest charges" and "Robinhood 1099 date" underscores the critical importance of accurate and timely tax reporting. The Robinhood 1099 date serves as a reminder for users to review their income and ensure that all earnings from Robinhood are properly reported to the Internal Revenue Service (IRS).

Failing to report income from Robinhood can have serious consequences, including:

- Penalties: The IRS may impose penalties on unreported income, which can significantly increase the amount of taxes owed.

- Interest charges: Interest accrues on unpaid taxes, further increasing the financial burden on the taxpayer.

For example, if a user fails to report $1,000 of income from Robinhood, they may face a penalty of $250 and interest charges that continue to accumulate until the unpaid taxes are resolved.

By understanding the consequences of failing to report income from Robinhood, users can take proactive steps to avoid these penalties and interest charges. Reviewing the 1099 form carefully and accurately reporting all income is essential for tax compliance and financial well-being.

In summary, the connection between "Consequences: Failing to report income from Robinhood can result in penalties and interest charges" and "Robinhood 1099 date" highlights the significance of timely and accurate tax reporting. By being aware of the potential consequences, users can make informed decisions and fulfill their tax obligations, reducing the risk of financial penalties and ensuring compliance with tax regulations.

FAQs

This section provides answers to frequently asked questions (FAQs) related to the Robinhood 1099 date, ensuring a comprehensive understanding of this important topic.

Question 1: When does Robinhood typically issue 1099 forms?

Robinhood typically issues 1099 forms in late January or early February of each year.

Question 2: Why is the Robinhood 1099 date important?

The Robinhood 1099 date is important because it helps users determine their tax liability associated with their Robinhood account activity. It also serves as a reminder to review income and ensure accurate tax reporting.

Question 3: How can I access my Robinhood 1099 form?

Robinhood users can access their 1099 forms online through their Robinhood account.

Question 4: What should I do if I have questions about my Robinhood 1099 form?

If you have questions about your Robinhood 1099 form, you can contact Robinhood's customer support team for assistance.

Question 5: What are the consequences of failing to report income from Robinhood?

Failing to report income from Robinhood can result in penalties and interest charges imposed by the IRS.

In conclusion, understanding the Robinhood 1099 date and its implications is crucial for accurate tax reporting and compliance. By addressing these FAQs, we aim to provide clarity and guidance, empowering users to navigate the tax season with confidence.

For further information and support, please refer to the relevant sections of this article.

Conclusion

The Robinhood 1099 date is a crucial piece of information for users of the Robinhood online brokerage platform. It determines when users can expect to receive their Form 1099 from Robinhood, which reports income earned from various sources, including dividends, capital gains, and interest.

Understanding the significance of the Robinhood 1099 date empowers users to fulfill their tax obligations, avoid penalties, and make informed financial decisions. By reviewing their 1099 forms carefully and reporting their income accurately, users can ensure compliance with tax regulations and optimize their tax strategies.

Detail Author:

- Name : Scottie Flatley

- Username : corkery.federico

- Email : berniece33@smitham.biz

- Birthdate : 2000-07-26

- Address : 9090 Deon Track North Adrianaville, GA 37691

- Phone : +18474134552

- Company : Marks-Daugherty

- Job : Tank Car

- Bio : Et sequi perspiciatis molestiae vitae. Neque neque ratione mollitia quis. Veritatis dolores dolor ipsum aut dolor quia qui sed. Omnis dolor beatae vel est quia sint.

Socials

tiktok:

- url : https://tiktok.com/@akutch

- username : akutch

- bio : Dolores nemo quia sed error architecto.

- followers : 1484

- following : 2418

instagram:

- url : https://instagram.com/arianekutch

- username : arianekutch

- bio : Quasi nisi est doloremque dignissimos qui. Minima tempora exercitationem rem aut.

- followers : 375

- following : 2944