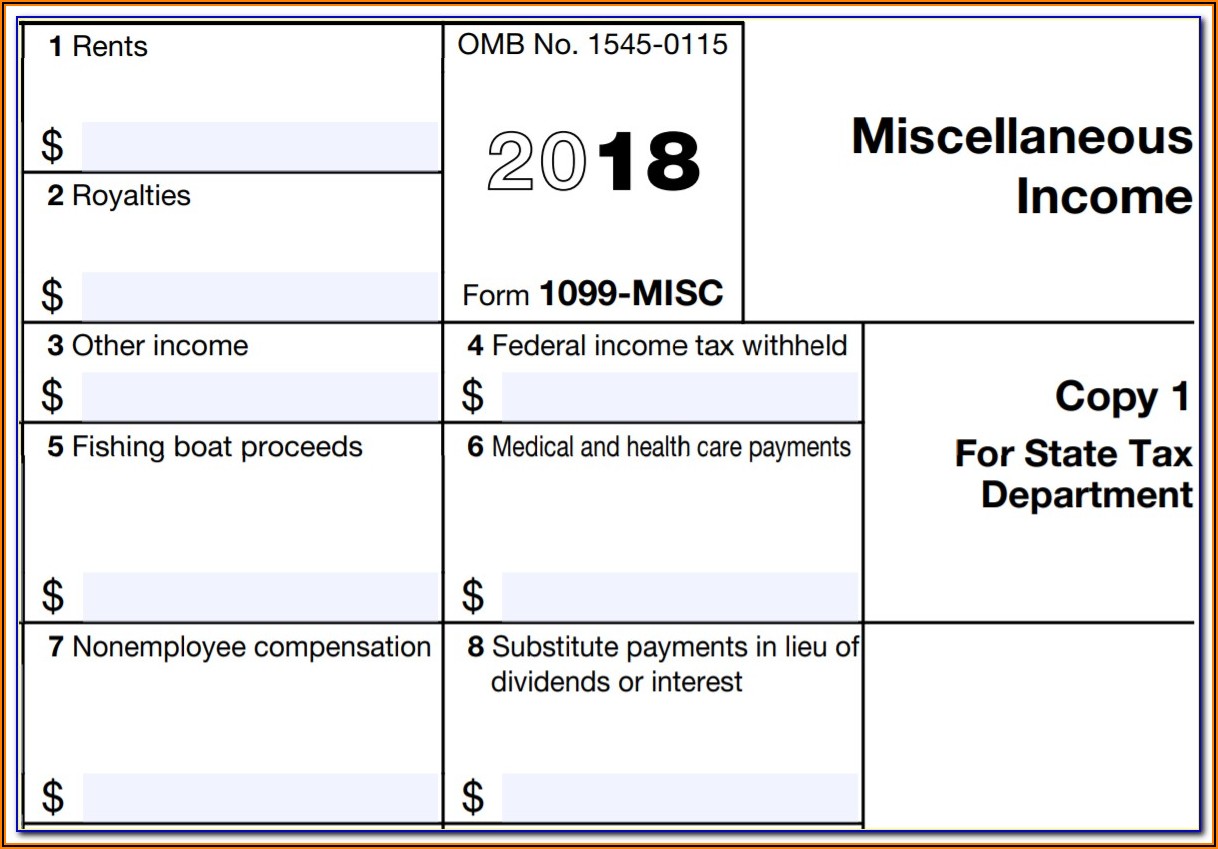

All About Federal Taxes Withheld Blank

Are you wondering what "federal income tax withheld blank" is?

It is a blank space on your tax return where you enter the amount of federal income tax that was withheld from your paycheck during the year. This amount is used to calculate your tax liability, which is the amount of tax you owe.

It is important to fill out this blank accurately, as it can affect the amount of your refund or the amount of tax you owe. If you are not sure how much federal income tax was withheld from your paycheck, you can check your pay stubs or contact your employer.

- Subhashree Sahu Mms Video Leaked Scandal Exposing The Truth Behind The Intimate Moments

- Filmyfly Xyz 2025 Hindi Dubbed Your Ultimate Source For Entertainment

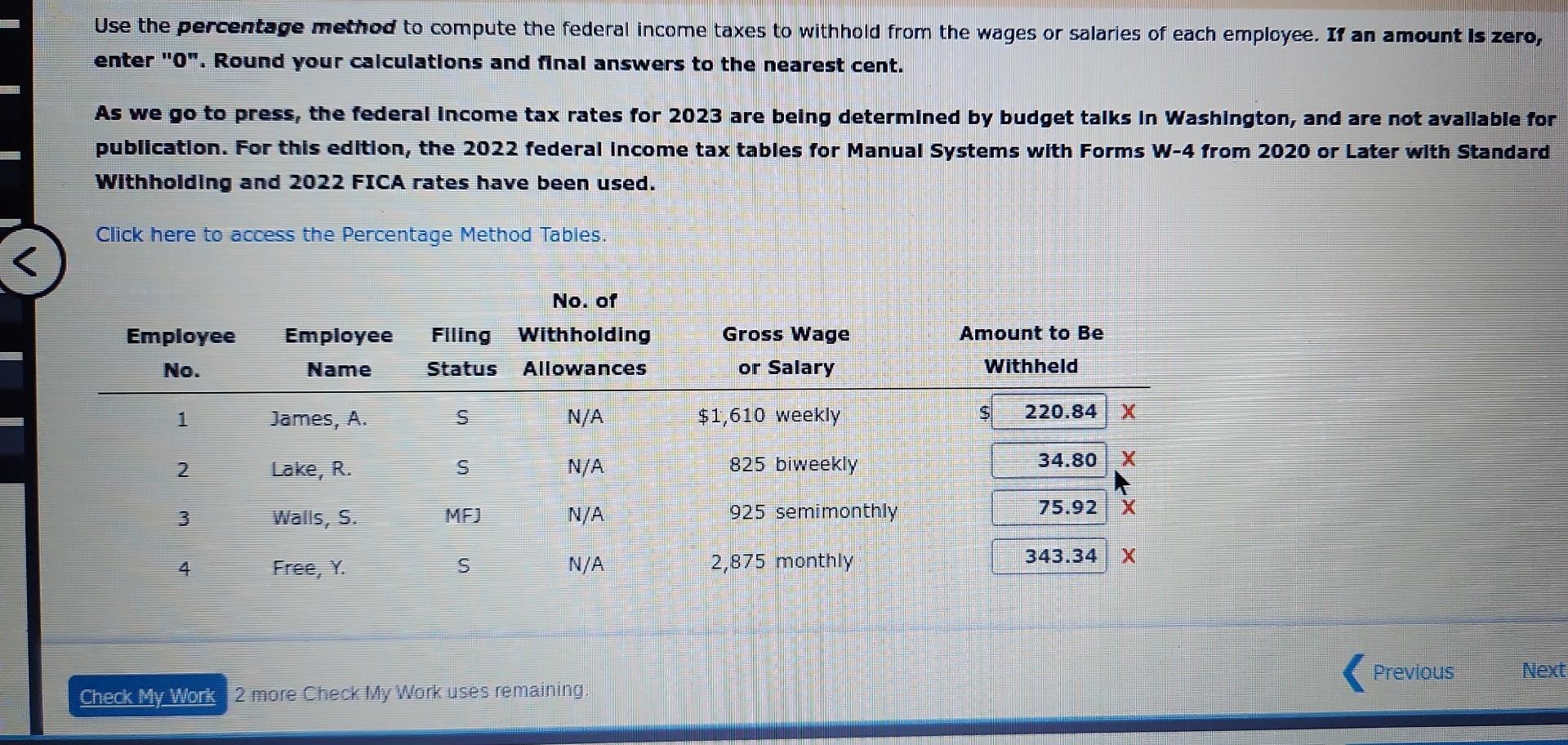

The amount of federal income tax withheld from your paycheck is determined by a number of factors, including your filing status, the number of allowances you claim on your W-4 form, and your income.

If you have too much federal income tax withheld from your paycheck, you will receive a refund when you file your tax return. If you have too little federal income tax withheld from your paycheck, you will owe money when you file your tax return.

federal income tax withheld blank

The federal income tax withheld blank is a crucial part of your tax return. It indicates the amount of federal income tax that was withheld from your paycheck during the year. This amount is used to calculate your tax liability, which is the amount of tax you owe. Here are 8 key aspects of the federal income tax withheld blank:

- Get Ready For Filmyfly 2025 Latest Movies Ndash Your Ultimate Streaming Destination

- Why Vegamoviessi Is A Mustvisit For Movie Lovers

- Amount: The amount of federal income tax withheld from your paycheck is determined by a number of factors, including your filing status, the number of allowances you claim on your W-4 form, and your income.

- Withholding allowance: A withholding allowance is a dollar amount that reduces the amount of federal income tax withheld from your paycheck. You can claim more withholding allowances if you have more dependents or if you itemize your deductions.

- W-4 form: The W-4 form is used to tell your employer how much federal income tax to withhold from your paycheck. You should update your W-4 form if you have a change in your filing status, the number of dependents you have, or your income.

- Refund: If you have too much federal income tax withheld from your paycheck, you will receive a refund when you file your tax return.

- Owe money: If you have too little federal income tax withheld from your paycheck, you will owe money when you file your tax return.

- Estimated taxes: If you are self-employed or have other income that is not subject to withholding, you may need to make estimated tax payments. Estimated taxes are payments that you make to the IRS on a quarterly basis.

- Penalties: If you do not pay enough estimated taxes, you may be subject to penalties.

- Tax liability: Your tax liability is the amount of tax that you owe. Your tax liability is calculated by subtracting your deductions and credits from your taxable income.

It is important to understand the federal income tax withheld blank and how it affects your tax liability. By understanding these key aspects, you can ensure that you are withholding the correct amount of federal income tax from your paycheck and that you are avoiding any penalties.

1. Amount

The amount of federal income tax withheld from your paycheck is a key factor in determining your tax liability. By understanding how these factors affect your withholding, you can ensure that you are withholding the correct amount of tax and avoiding any penalties.

- Filing status: Your filing status is a major factor in determining your withholding. There are five filing statuses: single, married filing jointly, married filing separately, head of household, and qualifying widow(er). Each filing status has different withholding rates.

- Number of allowances: You can claim allowances on your W-4 form to reduce the amount of federal income tax withheld from your paycheck. Each allowance reduces your withholding by a set amount. The more allowances you claim, the less federal income tax will be withheld from your paycheck.

- Income: Your income is another important factor in determining your withholding. The more you earn, the more federal income tax you will have withheld from your paycheck.

It is important to note that the amount of federal income tax withheld from your paycheck is not the same as your tax liability. Your tax liability is the amount of tax that you owe after taking into account all of your deductions and credits. You may owe additional tax when you file your tax return, even if you had federal income tax withheld from your paycheck.

2. Withholding allowance

Withholding allowances are an important part of the federal income tax withholding system. By understanding how withholding allowances work, you can ensure that you are withholding the correct amount of federal income tax from your paycheck and avoiding any penalties.

- Facet 1: How withholding allowances work

Withholding allowances reduce the amount of federal income tax that is withheld from your paycheck. Each withholding allowance is worth a specific dollar amount. The more withholding allowances you claim, the less federal income tax will be withheld from your paycheck. - Facet 2: Who can claim withholding allowances

You can claim withholding allowances if you have dependents or if you itemize your deductions. Dependents include children, spouses, and other qualifying relatives. You can also claim withholding allowances if you have certain types of income, such as self-employment income or investment income. - Facet 3: How to claim withholding allowances

You can claim withholding allowances on your W-4 form. The W-4 form is used to tell your employer how much federal income tax to withhold from your paycheck. You can also use the W-4 form to change your withholding allowances if your circumstances change. - Facet 4: The importance of claiming the correct number of withholding allowances

It is important to claim the correct number of withholding allowances. If you claim too few withholding allowances, you may have too much federal income tax withheld from your paycheck. This could result in a refund when you file your tax return, but it could also mean that you owe additional taxes. If you claim too many withholding allowances, you may not have enough federal income tax withheld from your paycheck. This could result in owing money when you file your tax return and could also lead to penalties.

Withholding allowances are a key part of the federal income tax withholding system. By understanding how withholding allowances work, you can ensure that you are withholding the correct amount of federal income tax from your paycheck and avoiding any penalties.

3. W-4 form

The W-4 form is a key part of the federal income tax withholding system. It is used to tell your employer how much federal income tax to withhold from your paycheck. The amount of federal income tax that is withheld from your paycheck is a key factor in determining your tax liability, which is the amount of tax that you owe.

- Facet 1: How the W-4 form works

The W-4 form is used to calculate the amount of federal income tax that should be withheld from your paycheck. The form takes into account your filing status, the number of dependents you have, and your income. The more dependents you have, the less federal income tax will be withheld from your paycheck. The higher your income, the more federal income tax will be withheld from your paycheck. - Facet 2: When to update your W-4 form

You should update your W-4 form if you have a change in your filing status, the number of dependents you have, or your income. You should also update your W-4 form if you start a new job or if you have a change in your withholding allowances. - Facet 3: The importance of claiming the correct number of withholding allowances

It is important to claim the correct number of withholding allowances on your W-4 form. If you claim too few withholding allowances, you may have too much federal income tax withheld from your paycheck. This could result in a refund when you file your tax return, but it could also mean that you owe additional taxes. If you claim too many withholding allowances, you may not have enough federal income tax withheld from your paycheck. This could result in owing money when you file your tax return and could also lead to penalties.

The W-4 form is a key part of the federal income tax withholding system. By understanding how the W-4 form works and how to claim the correct number of withholding allowances, you can ensure that you are withholding the correct amount of federal income tax from your paycheck and avoiding any penalties.

4. Refund

The "federal income tax withheld blank" on your tax return is directly connected to your potential refund. When you fill out your W-4 form, you indicate how much federal income tax you want withheld from each paycheck. If you overestimate your tax liability and have too much withheld, the excess amount will be refunded to you when you file your tax return.

For example, let's say you earn $50,000 per year and you claim two withholding allowances on your W-4 form. Based on this information, your employer will withhold a certain amount of federal income tax from each paycheck. However, if it turns out that you only owe $8,000 in taxes for the year, but your employer withheld $10,000, you will receive a refund of $2,000 when you file your tax return.

Understanding the connection between the "federal income tax withheld blank" and your refund is important because it can help you plan your finances and avoid surprises when you file your tax return. If you are consistently receiving large refunds, it may be a sign that you are overpaying your taxes. You can adjust your W-4 form to reduce the amount of withholding and increase your take-home pay.

Conversely, if you are consistently owing money when you file your tax return, it may be a sign that you are underpaying your taxes. In this case, you should increase the amount of withholding on your W-4 form to avoid penalties and interest charges.

By understanding the connection between the "federal income tax withheld blank" and your refund, you can make informed decisions about your withholding and ensure that you are paying the correct amount of taxes.

5. Owe money

The "federal income tax withheld blank" on your tax return is directly connected to your potential tax liability. When you fill out your W-4 form, you indicate how much federal income tax you want withheld from each paycheck. If you underestimate your tax liability and have too little withheld, you will owe money when you file your tax return.

- Facet 1: How underpaying taxes can lead to owing money

Underpaying your taxes occurs when the amount of federal income tax withheld from your paycheck is less than the amount of taxes you actually owe. This can happen for a variety of reasons, such as claiming too many withholding allowances on your W-4 form or having a change in your income or filing status. When you underpay your taxes, the IRS will charge you interest and penalties on the amount of tax that you owe. - Facet 2: The consequences of owing money when you file your tax return

Owing money when you file your tax return can have a number of negative consequences. The IRS may impose penalties and interest charges on the amount of tax that you owe. You may also have to pay estimated taxes in the following year to avoid owing money again. In some cases, the IRS may even take legal action against you to collect the taxes that you owe. - Facet 3: How to avoid owing money when you file your tax return

There are a number of things that you can do to avoid owing money when you file your tax return. First, make sure that you are claiming the correct number of withholding allowances on your W-4 form. You can use the IRS Withholding Calculator to help you determine the correct number of allowances to claim. Second, make estimated tax payments if you are self-employed or have other income that is not subject to withholding. Finally, file your tax return on time and pay any taxes that you owe in full.

Understanding the connection between the "federal income tax withheld blank" and owing money when you file your tax return is important for ensuring that you are meeting your tax obligations. By following the tips outlined above, you can avoid owing money when you file your tax return and the potential penalties and interest charges that come with it.

6. Estimated taxes

The "federal income tax withheld blank" on your tax return is directly connected to your estimated tax payments. If you are self-employed or have other income that is not subject to withholding, you are responsible for making estimated tax payments to the IRS. These payments are due on April 15, June 15, September 15, and January 15 of the following year.

- Facet 1: The purpose of estimated tax payments

Estimated tax payments are used to prepay the federal income tax that you owe on your self-employment income or other income that is not subject to withholding. By making estimated tax payments, you can avoid owing a large amount of taxes when you file your tax return. - Facet 2: How to calculate your estimated tax payments

To calculate your estimated tax payments, you will need to estimate your taxable income for the year. You can use your previous year's tax return as a starting point. Once you have estimated your taxable income, you can use the IRS Estimated Tax Worksheet to calculate your estimated tax payments. - Facet 3: The consequences of underpaying estimated taxes

If you underpay your estimated taxes, you may be subject to penalties and interest charges. The IRS will charge you interest on the amount of tax that you owe, and you may also be charged a penalty of 5% of the tax that you owe for each month that you underpaid your taxes. - Facet 4: How to avoid penalties and interest charges

To avoid penalties and interest charges, you should make your estimated tax payments on time and in full. You can make your estimated tax payments online, by mail, or by phone.

Understanding the connection between the "federal income tax withheld blank" and estimated tax payments is important for ensuring that you are meeting your tax obligations. By making estimated tax payments, you can avoid owing a large amount of taxes when you file your tax return and the potential penalties and interest charges that come with it.

7. Penalties

The "federal income tax withheld blank" on your tax return is directly connected to potential penalties if you do not pay enough estimated taxes. Estimated taxes are payments that you make to the IRS on a quarterly basis if you are self-employed or have other income that is not subject to withholding.

- Facet 1: The purpose of estimated tax payments

Estimated tax payments are used to prepay the federal income tax that you owe on your self-employment income or other income that is not subject to withholding. By making estimated tax payments, you can avoid owing a large amount of taxes when you file your tax return and the potential penalties that come with it. - Facet 2: The consequences of underpaying estimated taxes

If you underpay your estimated taxes, you may be subject to penalties and interest charges. The IRS will charge you interest on the amount of tax that you owe, and you may also be charged a penalty of 5% of the tax that you owe for each month that you underpaid your taxes. - Facet 3: How to avoid penalties

To avoid penalties, you should make your estimated tax payments on time and in full. You can make your estimated tax payments online, by mail, or by phone. - Facet 4: The connection to "federal income tax withheld blank"

The "federal income tax withheld blank" on your tax return is directly connected to your estimated tax payments. If you have too little federal income tax withheld from your paycheck, you may need to make estimated tax payments to avoid penalties.

Understanding the connection between the "federal income tax withheld blank" and penalties for underpaying estimated taxes is important for ensuring that you are meeting your tax obligations. By making estimated tax payments on time and in full, you can avoid penalties and interest charges, and ensure that you are paying the correct amount of taxes.

8. Tax liability

The "federal income tax withheld blank" on your tax return is directly connected to your tax liability. Your tax liability is the amount of tax that you owe after taking into account all of your deductions and credits. If you have too little federal income tax withheld from your paycheck, you may owe additional taxes when you file your tax return.

- Facet 1: How your tax liability is calculated

Your tax liability is calculated by subtracting your deductions and credits from your taxable income. Your taxable income is the amount of income that is subject to taxation. Deductions are expenses that you can subtract from your income before calculating your tax liability. Credits are amounts that you can subtract directly from your tax liability. - Facet 2: The connection between "federal income tax withheld blank" and your tax liability

The "federal income tax withheld blank" on your tax return is the amount of federal income tax that was withheld from your paycheck during the year. This amount is used to calculate your tax liability. If you have too little federal income tax withheld from your paycheck, you may owe additional taxes when you file your tax return. - Facet 3: The importance of withholding the correct amount of federal income tax

It is important to withhold the correct amount of federal income tax from your paycheck. If you withhold too little tax, you may owe additional taxes when you file your tax return. If you withhold too much tax, you will receive a refund when you file your tax return. - Facet 4: How to avoid owing additional taxes when you file your tax return

There are a number of things that you can do to avoid owing additional taxes when you file your tax return. First, make sure that you are withholding the correct amount of federal income tax from your paycheck. You can use the IRS Withholding Calculator to help you determine the correct amount of tax to withhold. Second, make estimated tax payments if you are self-employed or have other income that is not subject to withholding.

Understanding the connection between the "federal income tax withheld blank" and your tax liability is important for ensuring that you are meeting your tax obligations. By withholding the correct amount of tax and making estimated tax payments if necessary, you can avoid owing additional taxes when you file your tax return.

Frequently Asked Questions about "federal income tax withheld blank"

This section provides answers to some of the most frequently asked questions about "federal income tax withheld blank".

Question 1: What is "federal income tax withheld blank"?

The "federal income tax withheld blank" is a space on your tax return where you enter the amount of federal income tax that was withheld from your paycheck during the year. This amount is used to calculate your tax liability, which is the amount of tax you owe.

Question 2: Why is it important to fill out the "federal income tax withheld blank" accurately?

It is important to fill out the "federal income tax withheld blank" accurately because it can affect the amount of your refund or the amount of tax you owe. If you do not fill out this blank accurately, you may end up paying too much or too little tax.

Question 3: How can I determine the amount of federal income tax that was withheld from my paycheck?

You can determine the amount of federal income tax that was withheld from your paycheck by checking your pay stubs or contacting your employer.

Question 4: What should I do if I have too much or too little federal income tax withheld from my paycheck?

If you have too much federal income tax withheld from your paycheck, you will receive a refund when you file your tax return. If you have too little federal income tax withheld from your paycheck, you may owe money when you file your tax return.

Question 5: What are the consequences of not paying enough estimated taxes?

If you do not pay enough estimated taxes, you may be subject to penalties and interest charges. The IRS will charge you interest on the amount of tax that you owe, and you may also be charged a penalty of 5% of the tax that you owe for each month that you underpaid your taxes.

Summary:

It is important to understand the "federal income tax withheld blank" and how it affects your tax liability. By understanding these key aspects, you can ensure that you are withholding the correct amount of federal income tax from your paycheck and that you are avoiding any penalties.

Transition to the next article section:

Now that you have a better understanding of "federal income tax withheld blank," you can learn more about other important tax-related topics.

Conclusion

The "federal income tax withheld blank" is an important part of your tax return. It indicates the amount of federal income tax that was withheld from your paycheck during the year. This amount is used to calculate your tax liability, which is the amount of tax you owe.

It is important to understand the "federal income tax withheld blank" and how it affects your tax liability. By understanding these key aspects, you can ensure that you are withholding the correct amount of federal income tax from your paycheck and that you are avoiding any penalties.

If you have any questions about the "federal income tax withheld blank", you should consult with a tax professional.

Detail Author:

- Name : Bertram Kilback

- Username : jblick

- Email : laverne48@gmail.com

- Birthdate : 1984-08-19

- Address : 332 Timmy Alley West America, DE 86138-4892

- Phone : 1-773-297-8840

- Company : Witting Group

- Job : Librarian

- Bio : Enim maiores ut deleniti et itaque doloremque itaque. Veritatis dolores tempora quos a illo non. Corporis saepe et necessitatibus magni tempora. Consequatur hic nihil alias magni.

Socials

facebook:

- url : https://facebook.com/wyman1982

- username : wyman1982

- bio : Vero eligendi similique enim earum rerum.

- followers : 5194

- following : 1224

twitter:

- url : https://twitter.com/wymand

- username : wymand

- bio : Sit quae aut labore. Saepe quo beatae repudiandae accusantium labore.

- followers : 2887

- following : 2285

tiktok:

- url : https://tiktok.com/@dallin_dev

- username : dallin_dev

- bio : Perspiciatis ea reprehenderit recusandae.

- followers : 2962

- following : 2556